Child Maintenance Calculator

Child Maintenance refers to the care that is provided to your child in your absence by the caretakers. For this, you have to pay some amount of money to the caretakers for their service. Our child maintenance calculator helps you to calculate the child maintenance cost.

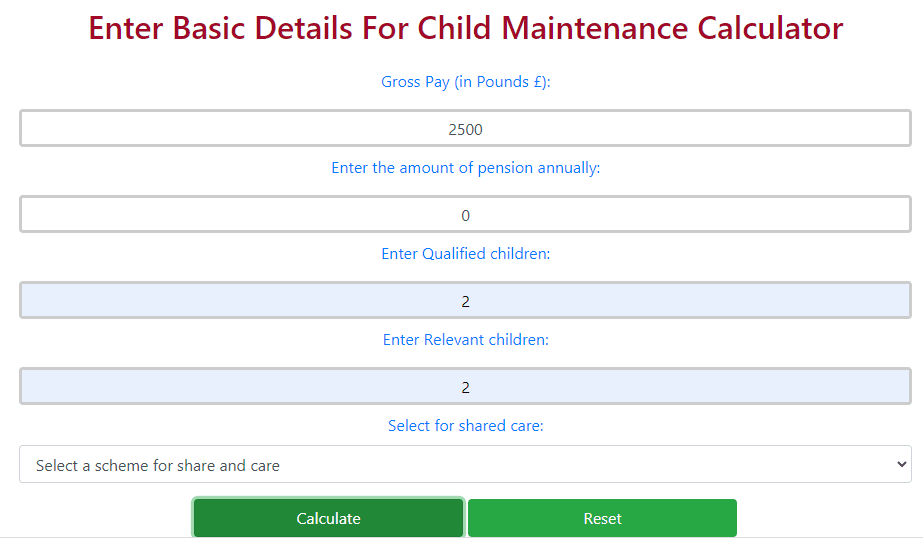

Enter Basic Details For Child Maintenance Calculator

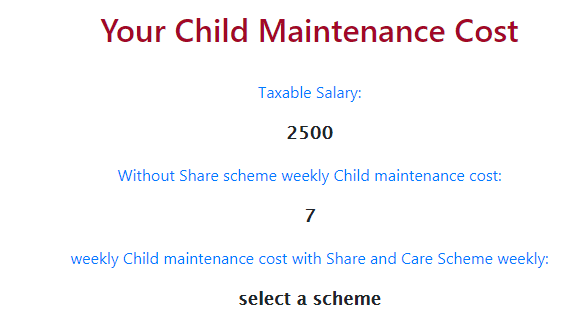

Your Child Maintenance Cost

Taxable Salary:

--

Without Share scheme weekly Child maintenance cost:

--

weekly Child maintenance cost with Share and Care Scheme weekly:

--

You can Find our More Tools and Calculators Here

Youtube Money Calculator Instagram Money Calculator Furlough Calculator Child Maintenance Calculator Font Changer Online Text Generator Online Font Style Online Aesthetic Symbols PUBG Stylish Text Generator Aesthetic Emojis Girlfriend Calculator Boyfriend Calculator Snapchat Font Generator Steam Font Generator Pretty Font Generator Horoscope Calculator Impact Font Generator Alien Font Generator Groovy Font Generator Unicode Font Generator GTA Font Generator Top Text Bottom Text Generator Camel Calculator Wife Calculator Husband CalculatorAbout the Child Maintenance Calculator

For calculating the cost of maintenance you should include all the required things in the account every week. Here you should include the cost of travel that is for the distance between your home and child home, Extra charges in case of any disability or illness, boarding school charges, etc. Child maintenance is continued till the baby is not 16 years or 20 years in case he is college. The total child maintenance is effected by your salary.

- When the Monthly income is unknown then default rates are applied £38 for one child, £51 for two children, £61 for three or more children.

- If your weekly salary is less than £7 you can't apply for the scheme.

- If your weekly salary is between £7 and £100 or if you’re on benefits you have to pay flat rates that are £7 every week.

- Weekly salary between £100.01 and £199.99, your rates will be reduced.

- If your weekly salary is between £200 and £3,000 in this case you have to pay basic rates.

There if your weekly income goes more than £3,000 by using a childcare service provider, Then you have to go to court for applying for top-up orders. The total number of children will also be considered. For one child you have to pay 12%, for 2 it will be 16% and in case three or more it will be 19%. You can use our more calculators like a Furlough Calculator for calculating your furlough Salary or if you want to check social media accounts like Youtuber's income then you can check our Youtube Money Calculator and Instagram Money Calculator for checking Instagram account details.

Gross Pay

- For calculating the childcare the annual salary is converted in monthly salary and monthly salary is converted weekly then weekly on a routine basis.

- First, the gross pay is divided by 365 days a year.

- In the second step, the result is multiplied by 7 this way the weekly and routine salaries are calculated.

- Then these calculated values are compared by the HMRC guidelines and the selected rates are applied for the result.

Pension

There In This childcare calculator, the nontaxable payments are reduced before the calculation like pension any fund ar any pension other like national insurance, etc.

- Pension.

- Traveling allowance.

- National insurance.

- Funds.

- Shares.

Qualified Children

Qualified children are those children that come under government schemes. There are five different rates are available according to the UK government:

- Nil rate.

- Flat rate.

- Reduced rate.

- Basic rate including 'basic rate plus'.

- Default rate.

These categories are selected according to the salary of the parents. These categories are being selected by UK government based on salary details provided by the parents.

The children that are not under any scheme are called relevant children.

How to use the ChildCare Calculator?

- For using Child Maintenance Calculator visit our website ToolCalculator.com.

- You have to enter the gross pay annually.

- If you are paying any pension then enter the amount of the pension.

- You should enter the total number of qualified children.

- You should enter the total number of relevant children.

- Select the scheme under which your baby is coming.

- Click the button to see the result.

Suppose your income is 2500 yearly. You have to enter this income in the calculator's gross pay. Now

your income will be calculated weekly by using formula gross pay multiplied by 365 and then divided by

7.

Now your weekly salary will be used to decide childcare rates. Here, in this case, your weekly pay is

47.94. Now, this income is less than £100.

This income is under Flat rates you have to pay £7 every week.

Output: In Result, you will get three things taxable salary that is after, calculated tax amount, and last if you are using the share and care scheme then the result is calculated according to a shared scheme.

Various Maintenance Rates

- Nil Rate: You have to pay nothing in this case.

- Flat Rate: You have to pay only £7 every week.

- Reduced Rate: In this case, you have to pay £7 for the first £100 and extra charges for another £100 you should use a Calculator here.

- Basic Rate +(left salary basic Rate): You have to use a calculator in this case.

- Default Rate: for one child £39 per week, £51 for two children, and £61 for three or more children.

Shared Care Calculator

The share and care schemes are used to specify the time for which your baby is living with the paying parents or receiving parent. There in the UK, many schemes are available and the tax rates are also decided according to it. Their different rates are available for different schemes. These schemes are provided by the HMRC government. In these schemes, time is calculated in days and nights. There is a range of specifying nights that your baby is living with you. It will reduce the child care cost if your baby stays with you. In case of share and care your charges are reduced.

- According to different schemes, different rates are applied.

- For 52 to 103 nights tax rates are 1/7

- For 104 to 155 nights tax rates are 2/7.

- For 156 to 174 nights tax rates are 3/7

- For more nights tax rates are 1/2 but 7 pounds extra charged for every week are added.

Features

This calculator is very helpful in calculating the overall cost of your childcare on a weekly, monthly, and yearly basis. You don't need to calculate manually you can easily check the detailed information about the child care if you have one, two, three, or more children. It is used by service provider agencies for calculating the cost of childcare so that they can claim. Here the detailed information of your children is required with your gross salary.

Frequently Asked Questions (FAQs)

1. How the calculator calculates the free 30 hours?

Ans. All is about your salary if your salary is at least £1,813.76 per month and your age is 25 Years or more then you can claim for free 30 hours childcare. It means if you earn £12 every hour then you can apply for the free 30 hours child care policy in the UK. Annually your Income should be less Than £100000 only then it is possible to get 15 hours or 30 hours of free child care.

2. What is included in the child care calculator?

Ans. There in this child care calculator, your salary is included. Then the nontaxable amounts are reduced first. Then your childcare is calculated according to qualified children and relevant children. Here your salary is the main criteria because all the decisions are according to your weekly income.

3. Is it according to HMRC guidelines?

Ans. Yes, all the rules used here are according to HMRC guidelines. Like the deduction rates used in this calculator are provided by HMRC. Child care schemes available are also provided by HMRC. Discounts on childcare rates according to children is also used that is provided on the HMRC website. The Purpose of the calculator is to provide the guidance and easy way of calculation.